Pension changes coming into effect in 2024 will affect many citizens who are already receiving pensions or preparing for retirement. The Singapore government regularly reviews pension programs to ensure that the population is financially stable and adapts to demographic changes. In 2024, there will be several key changes regarding pension benefits, accumulation schemes, and retirement savings management.

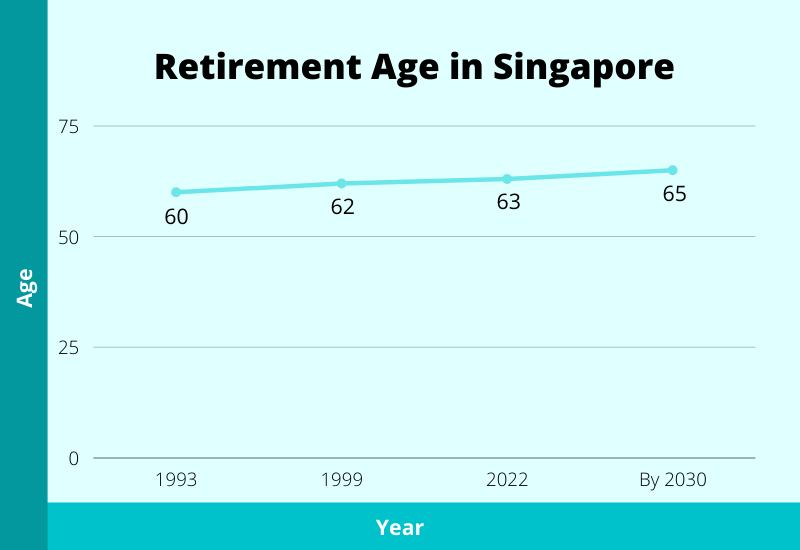

Increase in the retirement age

One of the main changes in 2024 will be a gradual increase in the age at which workers can start taking pension payments from their savings. The current minimum age is 62, but the government has announced a phased increase to 65 by 2030. In 2024, the retirement age will be increased by one year to 63. This change is aimed at ensuring that people stay in the workforce for longer and have more time to save for retirement.

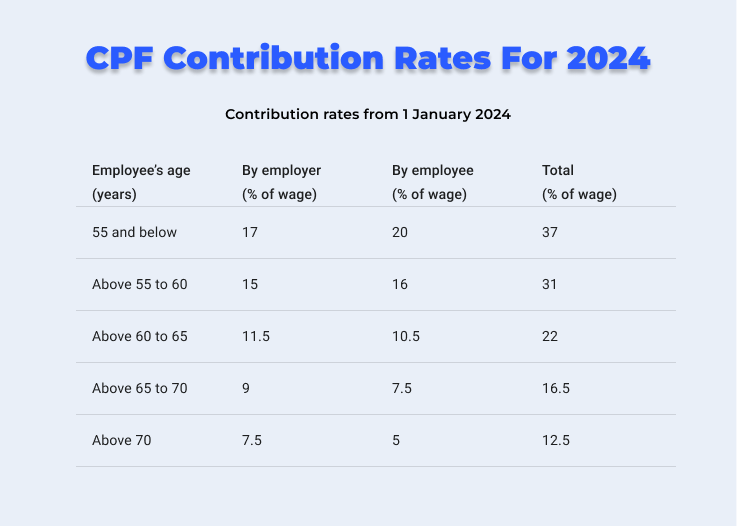

Increase in contributions to the Central Provident Fund (CPF)

Another major change in 2024 will be an increase in mandatory contributions to the Central Provident Fund (CPF) for those aged 55 to 70. The CPF is a key pension scheme in Singapore that allows workers to save for their old age. In 2024, CPF contributions for those over 55 will be increased by 1-2%, depending on age. This change aims to provide more savings for the elderly and improve their financial resilience.

New benefits and support for low-income pensioners

Additional benefits and support programs will be introduced for those with low income or savings. In 2024, the government will introduce a new initiative to increase payments to pensioners who earn less than a certain level of income. This measure is aimed at supporting the most vulnerable in society and ensuring them a decent standard of living. Benefits for medical services and housing subsidies for senior citizens will also be expanded.

Changes in the CPF LIFE program

CPF LIFE is a program that provides lifetime monthly payments from retirement savings. In 2024, there will be changes to the CPF LIFE options that will allow retirees more flexibility in managing their benefits. For example, there will be an option to choose an increased payout for a shorter period of time, which may be useful for those who prefer to receive most of their funds in the early years of retirement.

Impact on employers

Employers will also face changes in pension legislation as they will have to adapt to new CPF contribution requirements for their employees. In 2024, additional benefits will be introduced for employers hiring workers over the age of 55, including tax relief and subsidies for vocational training. This should help reduce the cost of hiring older workers and support them to remain active in the labor force.

Improvement of pension programs for the self-employed

There are also changes for the self-employed in Singapore. In 2024, a new scheme will be introduced to allow these categories of workers to make voluntary CPF contributions on favorable terms to help them save more for retirement. The government will also offer more favorable conditions for participation in health insurance and old-age savings programs.

What retirees and those preparing for retirement need to know

The 2024 pension changes aim to improve the financial sustainability of the system in the long term. Nevertheless, it is important that citizens plan their finances in advance, taking into account the new rules. Pensioners are advised to regularly review their pension savings and consult financial experts for advice on how to best manage their funds.

Changes to Singapore's pension system in 2024 will affect many people and will require adaptation to the new environment. Increases in the retirement age, changes to the CPF and support for low-income pensioners are all aimed at ensuring the stability of the system and improving the quality of life of senior citizens. It is important to stay aware of the changes and plan your actions to adapt to the new conditions.